Project Details

Title: NANCI: Interactive Voice Assistant for an AutoFinance Company

Role: Lead Conversational Designer, Product Owner

Tools: Lucidchart, Voiceflow, IBM Watson

Overview

This 2-year client engagement involved helping them to retire their old touch-tone system with solely DTMF input and migrate to an IVA (interactive voice assistant) platform with NLU capabilities and proper skills routing to human agents.

How do we erase previous baggage from poorly designed IVR experiences and encourage user self-service?

Research

I’m sure you can easily recall a poor experience you've had calling into an automated phone system. Let’s face it, we dread dealing with any phone channel and anticipate we’ll face frustration at one point or another. For our user research, our team dove in deep to discover the many pain points users face, remember, and go through hoops to avoid in future engagements with their voice customer service channels.

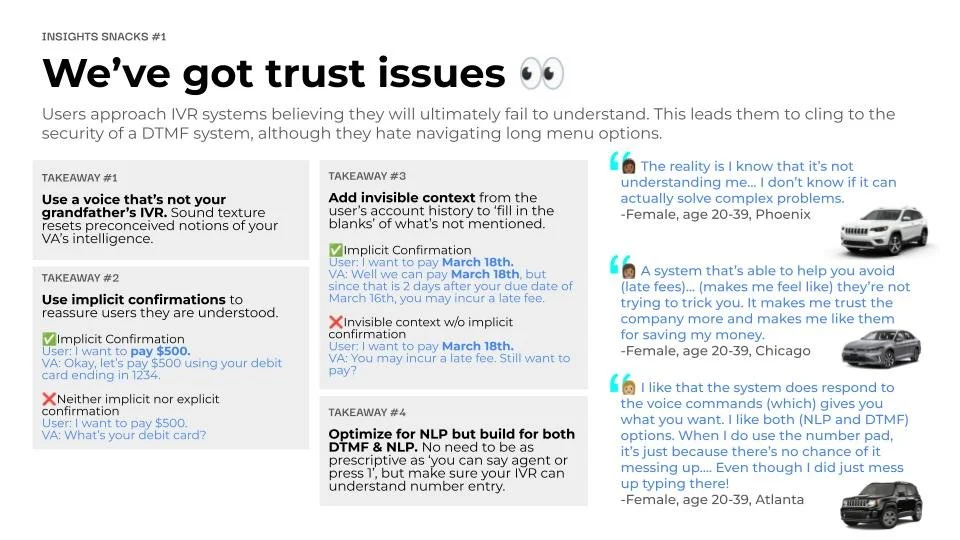

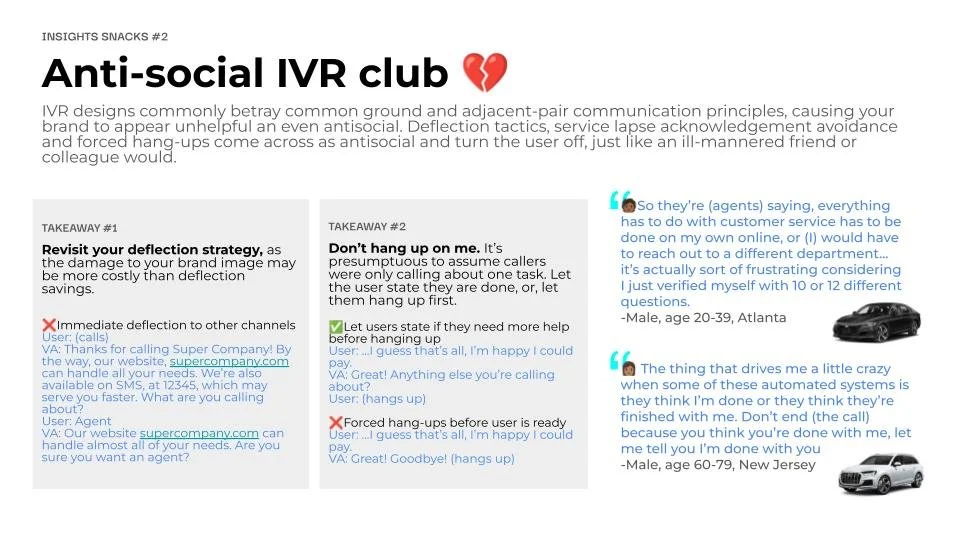

We faced the challenge of partnering with a client that not only misunderstood the role of designers but also failed to understand the importance of user research. To help encourage an appetite, we introduced “Insight Snacks” that highlighted pain points in an easy-to-digest manner, piquing the interest of our business-minded stakeholders. They immediately fell in love with the findings and even began quoting them back during PI planning events and updates with executives.

Overall, our research methodology included qualitative data collected through one-on-one interviews with autofinance customers, competitive analysis of other IVR experiences across the industry, and “Wizard of Oz” testing over the newly released MVP use cases.

Goals

Develop a virtual assistant personality and design patterns to improve user engagement.

We kicked off the design process with workshops to help stakeholders develop a personality for The Auto Financer’s voice assistant. We provided ample HCI related research to help the decision making process and ultimately created Nanci, the financer’s female virtual assistant.

Increase authentication and overall containment rates.

The previous system struggled to meet an authentication rate (number of users who successfully authenticated) of 40% and a containment rate (callers who did not need the assistance of an agent) of about 7%.

Increase Nanci’s transactional functionality to help users complete tasks.

The IVR’s previous functionality only allowed for authentication completion and didn’t include any self-service. Therefore, all calls were escalated to an agent. Through strategically implementing prioritized use cases to automate certain tasks, we can increase containment, decrease agent handle time, and reserve complex cases for human engagement.

Proactive design

Users need to trust that their financial institution will remain transparent and full of integrity. Therefore, an agent representing the brand should give straightforward notice of important dates and fees.

Solution

Conditional Authentication

The initial flow design was very rigid and required all callers to authenticate with Nanci, which included users that didn’t have an account such as sales agents and non-customers. It also proved difficult to use for users who didn’t have their account number at hand. To improve task efficiency, the new flow design included listening for intents associated with these forgotten user groups.

The biggest overhaul was having Nanci ask for the user’s intent more up front. Not all intents required account information, so why authenticate first?

Billing Inquiries and Payments

Users can inquire with Nanci about last, current, and upcoming payments and ask questions such as “When’s my next autopayment?” or “What’s this fee on my bill?”

Nanci also facilitates bill payments by connecting with the user’s online profile to gather billing and payment information. We designed this use case to expedite the task completion by defaulting to previously used payment methods, outstanding payments, and same-day scheduling.